Benefits of the Sizl

Network Leasing Program.

Leasing provides many benefits, but the most important is better cash flow for your company.

With little in the way of up-front costs–leasing is easier and faster than bank financing.

-

Conserve Capital /Keep Your Reserves

Leasing converves your working capital by

requiring usually just the first and last

payment. This frees your working capital

for other profit generating activities or

investments. -

Keep Bank Lines of Credit Available

Leasing preserves your bank lines of credit so

that you are ready if a business opportunity or

unexpected demand for cash occurs. -

Tax Advantages / Large Deductions

Leasing allows you a “dollar for dollar”

write off of the lease rental payments.

The depreciation advantage of ownership

is far less attractive when compared to

leasing. -

100% Financing of Product / Equipment

Leasing provides 100% financing. Consulting,

maintenance, freight, installation and training

costs, may be included in the lease. -

No Obsolete Equipment

Leasing affords you the opportunity to

add-on, upgrade or replace obsolete

equipment. -

Custom Tailored to Business Needs

Leasing can be tailored to fit your budget

requirements. At the end of the lease term,

you will have the option of purchasing the

equipment, re-leasing equipment or returning

the equipment to the Lessor.

Over 1/3 of all acquired

equipment in the U.S. is leased.

Contact us to learn more or to start your leasing program today.

Get StartedLeasing is the

Sensible Solution

for Your Business.

Leasing is an affordable way to acquire

equipment quickly without huge out of

pocket expenses.

Through the Sizl Network we can assist your business with all your leasing needs.

Why not benefit now rather than wait

until you have the cash on hand. Even if

you have the reserves, spreading the cost

evently will free up your hard earned

money and keep your assets where they

belong…with your business.

Equipment leasing is a great way to get

the business gear that your company

needs to grow.

What can you lease? Just about any hard

asset, from computers to furniture to

heavy machinery to restaurant equipment,

even on Start-ups!

Over 85% of Merchant Applicants

are approved. Money made simple.

The Sizl Network offers 100% financing for remodel, reimage, and refreshing business concepts with 3+

years’ time in business. This can include 50% equipment and 50% construction cost over 24-60 month terms.

Fast approvals and funding with no cost or obligation quote.

-

- Restaurants

- Fitness

- Automotive

- Hospitality

- Spa

- Salon

- Restoration

- Retail

- Construction

- Manufacturing

- Titled Vehicles

- I.T.

-

- 24-48 Hour Approvals / Responses

- Tax Deductible

- 24-60 Month Terms

- Build Business Credit / Tradeline Development

- 100% Financing

- Low Fixed Monthly Payment

- No Personal Collateral

- Simple Documentation

- Preserve Capital for Business

- Off Balance Sheet Financing

-

- Kitchen Equipment

- Furniture, Fixtures/Millwork

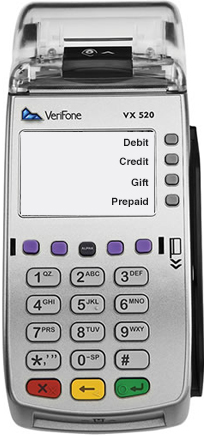

- POS Systems (software/hardware)

- Inventory

- Business Improvements

- Service Costs

- Signage (Interior/Exterior)

- Vehicles (New or Used)

- Gym Equipment

- And more…just ask!